- Home

- About

- Deals

-

Products

-

Crawl Space & Basement Dehumidifiers

- AlorAir® Sentinel HD55S with WiFi

- Alorair Sentinel HDi65S Black WIFI

- AlorAir® Sentinel HS35

- AlorAir® Sentinel HD35P

- AlorAir® Sentinel HD55P

- AlorAir® Sentinel HD55

- AlorAir® Sentinel HD55S (Gold)

- AlorAir® Sentinel HD55S (White)

- AlorAir® Sentinel HDi90 (Built-in Pump)

- AlorAir® Sentinel HD90

- AlorAir® Sentinel HDi90 (Duct-able)

- AlorAir® Sentinel HDi 100

- AlorAir® Sentinel HDi 120

- AlorAir® Galaxy 60P

- Sentinel HD35P WIFI

- AlorAir® Sentinel HD55 Blue WIFI

- AlorAir Sentinel HDi90 WIFI

- AlorAir® Helios D35 Crawlspace Dehumidifier

- AlorAir® Galaxy 60

- AlorAir® Galaxy 85P

- Whole House Dehumidifiers

-

Commercial & Industrial Dehumidifiers

- AlorAir® Sentinel Elite 80X

- AlorAir® Sentinel Elite 60X

- AlorAir® Sentinel Elite 50X

- AlorAir® Sentinel Pro 55X

- AlorAir® Sentinel Pro 35X

- AlorAir® Sentinel SLGR 1400X

- AlorAir® Storm 80X

- AlorAir® Storm DP Single-Voltage

- AlorAir® Storm Ultra

- AlorAir® Storm Elite

- AlorAir® Storm Pro Dehumidifier

- AlorAir® Storm LGR 1250

- AlorAir® Storm LGR 1250X

- AlorAir® Storm LGR 850

- AlorAir® Storm LGR 850X

- AlorAir® Storm LGR Extreme Smart App Control

- AlorAir® Storm LGR Extreme (Hot Sale)

-

Commercial HEPA Air Scrubbers

- AlorAir® PureAiro HEPA Max 970

- AlorAir® PureAiro HEPA Max 870

- AlorAir® PureAiro HEPA Max 770

- AlorAir® PureAiro HEPA Pro 970

- AlorAir® PureAiro HEPA Pro 870

- AlorAir® PureAiro HEPA Pro 770

- AlorAir® Cleanshield HEPA 550 (Hot Sale)

- Purisystems S1 UVIG Air Scrubber

- Purisystems S1 UV Air Scrubber

- Purisystems S1 Air Scrubber

- Purisystems HEPA 600 UVIG (Medical Grade)

- Purisystems HEPA Pro UVIG (Industrial Grade)

- Purisystems S2 Air Scrubber (Industrial Grade)

- Purisystems S2 UV Air Scrubber (Industrial Grade)

- Purisystems S2 UVIG Air Scrubber (Industrial Grade)

-

Woodshop Air Filtration System

- AlorAir® Purecare 1050IG

- AlorAir® Purecare 1050

- AlorAir® Purecare 780S

- AlorAir® Purecare 1080IG

- AlorAir® Purecare 1080

- AlorAir® Purecare 780IG

- AlorAir® Purecare 780

- AlorAir® Purecare 1350IG

- AlorAir® Purecare 1350

- Purisystems Puricare 1100

- Purisystems Puricare 1100IG

- Purisystems Puricare 500

- Purisystems Puricare 500IG

-

Air Mover

- AlorAir® Zeus Extreme Axial Air Mover

- AlorAir® Zeus 900 Air Mover

- AlorAir® 600 CFM Air Mover Blower Fan

- AlorAir® GE1000AT Air Mover Blower Fan

- AlorAir® GE1000T Air Mover Blower Fan

- AlorAir® GE1000A Air Mover Blower Fan

- AlorAir® GE1000 Air Mover Blower Fan

- AlorAir® GE4000HCW Air Mover Blower Fan

- AlorAir® GE4000HTC Air Mover Blower Fan

- AlorAir® GE4000TC Air Mover Blower Fan

- AlorAir® GE3000HCW Air Mover Blower Fan

- AlorAir® GE4000T Air Mover Blower Fan

- AlorAir® GE3000HTC Air Mover Blower Fan

- AlorAir® GE3000TF Air Mover Blower Fan

- AlorAir® GE3000T Air Mover Blower Fan

- AlorAir® GE2000HCW Air Mover Blower Fan

- AlorAir® GE2000TF Air Mover Blower Fan

- AlorAir® GE2000T Air Mover Blower Fan

- AlorAir® Air Drying System

- SLGR Dehumidifiers

-

Ventilation Fans

- AlorAir® Ventirpro 720

- AlorAir® Ventirpro 540

- AlorAir® Ventirpro 260

- AlorAir® VentirMax 780SD

- AlorAir® VentirMax 570SD

- AlorAir® VentirMax 300SD

- AlorAir® VentirPro-S2

- AlorAir® VentirPro 260S

- AlorAir® VentirPro 540S

- AlorAir® VentirPro 720S

- AlorAir® VentirMax 300S

- AlorAir® VentirMax 570S

- AlorAir® VentirMax 780S

- Electric Heat Drying Systems

- Crawl Space Encapsulation and Repair

-

Wifi Dehumidifier

-

Crawl Space & Basement Dehumidifiers

- Shop

- Crawl Space & Basement Dehumidifiers

- Whole House Dehumidifiers

- Commercial & Industrial Dehumidifiers

- Commercial HEPA Air Scrubbers

- Woodshop Air Filtration System

- Air Mover

- SLGR Dehumidifiers

- Ventilation Fans

- Electric Heat Drying Systems

- Filter & Other Accessories

- Crawl Space Encapsulation and Repair

- Wifi Dehumidifier

-

Applications

- Managing Air

- Basement Dehumidification

- Carpet Cleaning

- Crawl Space Dehumidification

- Fire Damage Restoration

- Flood Dehumidification

- Mold Removal

- Water Damage Restoration

- Indoor Swimming Pool

- Grow Room & Tent Optimization

- Pharmaceutical Production

- Supermarket Grocery & Retail

- Warehouse & Storage

- Laboratory & Cleanrooms

- Basement Wine Cellar

- Gyms & Fitness Center

- Guest Rooms & Hotels

- Support

- Learning

- Community

- Blog

- Distributor

- Login/Register

- About

-

Deals

- Products

-

AlorAir® Sentinel HD55S with WiFi

![AlorAir® Sentinel HD55S with WiFi]()

Capacity

120 PPD at Saturation, 55 PPD at AHAM

Size for

1300 sq.ft

Draining

Gravity Drainage

Unit Dimensions

12.2"D x 19.2"W x 13.3"H

-

Alorair Sentinel HDi65S Black WIFI

![Alorair Sentinel HDi65S Black WIFI]()

Capacity

120 PPD at Saturation, 55 PPD at AHAM

Coverage

1300 sq.ft

Draining

Pump drainage/Gravity drain

Unit Dimensions

12.2" D X19.2" W X13.3" H

-

AlorAir® Sentinel HS35

![AlorAir® Sentinel HS35]()

Capacity

70 PPD at Saturation, 35 PPD@AHAM

Size for

1000 sq.ft

Draining

Gravity drainage

Unit Dimensions

15.35 × 11.2 × 11.4 in

-

AlorAir® Sentinel HD35P

![AlorAir® Sentinel HD35P]()

Capacity

70 PPD at Saturation, 35 PPD@AHAM

Coverage

1000 sq.ft

Draining

Pump drainage/Gravity drain

Unit Dimensions

15.35 × 11.2 × 11.4 in

-

AlorAir® Sentinel HD55P

![AlorAir® Sentinel HD55P]()

Capacity

120 PPD at Saturation, 55 PPD@AHAM

Size for

1500 sq.ft

Draining

Pump drainage/Gravity drain

Unit Dimensions

17.64 x 11.69 x 11.85in

-

AlorAir® Sentinel HD55

![AlorAir® Sentinel HD55]()

Capacity

113 PPD at Saturation, 53PPD@AHAM

Size for

1200 sq.ft

Draining

Gravity Drainage

Unit Dimensions

12.2"D x 19.2"W x 13.3"H

-

AlorAir® Sentinel HD55S (Gold)

![AlorAir® Sentinel HD55S (Gold)]()

Capacity

120 PPD at Saturation, 55 PPD@AHAM

Size for

1300 sq.ft

Draining

Gravity Drainage

Unit Dimensions

12.2" D X19.2" W X13.3" H

-

AlorAir® Sentinel HD55S (White)

![AlorAir® Sentinel HD55S (White)]()

Capacity

120 PPD at Saturation, 55 PPD@AHAM

Size for

1300 sq.ft

Draining

Gravity Drainage

Unit Dimensions

12.2"D x 19.2"W x 13.3"H

-

AlorAir® Sentinel HDi90 (Built-in Pump)

![AlorAir® Sentinel HDi90 (Built-in Pump)]()

Capacity

198 PPD at Saturation, 90 PPD@AHAM

Size for

2600 sq.ft

Draining

Pump Drainage

Unit Dimensions

15.2" D x 23.2" W x 17.7" H

-

AlorAir® Sentinel HD90

![AlorAir® Sentinel HD90]()

Capacity

198 PPD at Saturation, 90 PPD@AHAM

Size for

2600 sq.ft

Draining

Gravity Drainage

Unit Dimensions

15.2" D x 23.2" W x 17.7" H

-

AlorAir® Sentinel HDi90 (Duct-able)

![AlorAir® Sentinel HDi90 (Duct-able)]()

Capacity

198 PPD at Saturation, 90 PPD@AHAM

Size for

2600 sq.ft

Draining

Pump Drainage

Unit Dimensions

15.2" D x 23.2" W x 17.7" H

-

AlorAir® Sentinel HDi 100

![AlorAir® Sentinel HDi 100]()

Capacity

220 PPD at Saturation, 100 PPD@AHAM

Size for

2900 sq.ft

Draining

Pump Drainage

Unit Dimensions

14.7" D x 23.8" W x 17.9" H

-

AlorAir® Sentinel HDi 120

![AlorAir® Sentinel HDi 120]()

Capacity

235 PPD at Saturation, 120 PPD@AHAM

Size for

3300 sq.ft

Draining

Pump Drainage

Unit Dimensions

14.7" D x 23.8" W x 17.9" H

-

AlorAir® Galaxy 60P

![AlorAir® Galaxy 60P]()

Capacity

145 PPD at Saturation

Size for

1800 sq.ft

Unit Dimensions

21.3"D x 14.1"W x 11.7"H

-

Sentinel HD35P WIFI

![Sentinel HD35P WIFI]()

Capacity

70 PPD at Saturation, 35 PPD at AHAM

Coverage

1000 sq.ft

Draining

Pump drainage/Gravity drain

Unit Dimensions

15.35 × 11.2 × 11.4 in

-

AlorAir® Sentinel HD55 Blue WIFI

![AlorAir® Sentinel HD55 Blue WIFI]()

-

AlorAir Sentinel HDi90 WIFI

![AlorAir Sentinel HDi90 WIFI]()

Capacity

198 PPD at Saturation, 90 PPD at AHAM

Coverage

2600 sq.ft

Draining

Pump Drainage

Unit Dimensions

15.2" D x 23.2" W x 17.7" H

-

AlorAir® Helios D35 Crawlspace Dehumidifier

![AlorAir® Helios D35 Crawlspace Dehumidifier]()

Capacity

70 PPD at Saturation

Size for

1000 sq.ft

Unit Dimensions

16.40 x 11.25 x 10.76 in

-

AlorAir® Galaxy 60

![AlorAir® Galaxy 60]()

Capacity

145 PPD at Saturation

Size for

1800 sq.ft

Unit Dimensions

21.3"D x 14.1"W x 11.7"H

-

AlorAir® Galaxy 85P

![AlorAir® Galaxy 85P]()

Capacity

180 PPD at Saturation

Size for

2300 sq.ft

Unit Dimensions

21.3"D x 14.1"W x 11.7"H

Crawl Space & Basement Dehumidifiers

-

AlorAir® Sentinel WHD 100

![AlorAir® Sentinel WHD 100]()

Size for

2300 Sq.Ft

AHAM, (80°F, 60% RH)(Pints)

90 Pints

Airflow

229CFM, 309CFM

Unit Dimensions

22.64"D x 14.65"W x 19.88"H

-

AlorAir® Sentinel WHD 120

![AlorAir® Sentinel WHD 120]()

Size for

3000 Sq.Ft

AHAM, (80°F, 60% RH)(Pints)

104 Pints

Airflow

229CFM, 309CFM

Unit Dimensions

22.64"D x 14.65"W x 19.88"H

-

AlorAir® Sentinel WHD 150

![AlorAir® Sentinel WHD 150]()

Size for

3500 Sq.Ft

AHAM, (80°F, 60% RH)(Pints)

140 Pints

Airflow

309CFM, 383CFM

Unit Dimensions

37.3"D x 23.4"W x 24.3"H

-

AlorAir® Sentinel WHD 200

![AlorAir® Sentinel WHD 200]()

Size for

4500 Sq.Ft

AHAM, (80°F, 60% RH)(Pints)

165 Pints

Airflow

309CFM, 413CFM

Unit Dimensions

37.3"D x 23.4"W x 24.3"H

Whole House Dehumidifiers

-

AlorAir® Sentinel Elite 80X

![AlorAir® Sentinel Elite 80X]()

Capacity

170 Pints

Size for

2,100 Sq.Ft

Air Flow

210CFM,358 CMH

Unit Dimensions

16.14" L x 15.15" W x 26.85" H

-

AlorAir® Sentinel Elite 60X

![AlorAir® Sentinel Elite 60X]()

Capacity

145 Pints

Size for

1,500 Sq.Ft

Air Flow

132CFM, 225CMH

Unit Dimensions

16.14" L x 15.15" W x 26.85" H

-

AlorAir® Sentinel Elite 50X

![AlorAir® Sentinel Elite 50X]()

Capacity

110 Pints

Size for

1,300 sq.ft

Air Flow

132CFM, 225CMH

Unit Dimensions

20.37" L x 19.33" W x 32.5" H

-

AlorAir® Sentinel Pro 55X

![AlorAir® Sentinel Pro 55X]()

Capacity

120 PPD at Saturation, 55 PPD@AHAM

Size for

1500 sq.ft

Air Flow

187 CFM/318CMH

Unit Dimensions

12.9"D x 14.14"W x 24.55"H

-

AlorAir® Sentinel Pro 35X

![AlorAir® Sentinel Pro 35X]()

Capacity

70 PPD at Saturation, 35 PPD@AHAM

Size for

1000 sq.ft

Air Flow

180 CFM/306CMH

Unit Dimensions

12.9"D x 14.14"W x 24.55"H

-

AlorAir® Sentinel SLGR 1400X

![AlorAir® Sentinel SLGR 1400X]()

Capacity

275 PPD at Saturation, 140 PPD@AHAM

Size for

3800 sq.ft

Air Flow

440 CFM, 680 CMH

Unit Dimensions

15.2"D x 14.4"W x 24.8"H

-

AlorAir® Storm 80X

![AlorAir® Storm 80X]()

![AlorAir® Storm 80X]()

![AlorAir® Storm 80X]()

![AlorAir® Storm 80X]()

Capacity

170 PPD at Saturation, 80 PPD@AHAM

Size for

2100 sq.ft

Draining

Pump Drainage

Unit Dimensions

15.2"D x 14.4"W x 24.8"H

-

AlorAir® Storm DP Single-Voltage

![AlorAir® Storm DP Single-Voltage]()

![AlorAir® Storm DP Single-Voltage]()

Capacity

110 PPD at Saturation, 50 PPD@AHAM

Coverage

1300 sq.ft

Draining

Pump Drainage

Unit Dimensions

14" D x 17" W x 23.1" H

-

AlorAir® Storm Ultra

![AlorAir® Storm Ultra]()

![AlorAir® Storm Ultra]()

![AlorAir® Storm Ultra]()

![AlorAir® Storm Ultra]()

Capacity

190 PPD at Saturation, 90 PPD@AHAM

Coverage

2600 sq.ft

Draining

Pump Drainage

Unit Dimensions

21.2" D×22" W×38" H

-

AlorAir® Storm Elite

![AlorAir® Storm Elite]()

![AlorAir® Storm Elite]()

![AlorAir® Storm Elite]()

![AlorAir® Storm Elite]()

Capacity

270 PPD at Saturation, 125 PPD@AHAM

Coverage

3000 sq.ft

Draining

Pump Drainage

Unit Dimensions

22.3" D×23.6" W×39.7" H

-

AlorAir® Storm Pro Dehumidifier

![AlorAir® Storm Pro Dehumidifier]()

![AlorAir® Storm Pro Dehumidifier]()

![AlorAir® Storm Pro Dehumidifier]()

![AlorAir® Storm Pro Dehumidifier]()

Capacity

180 PPD at Saturation, 85 PPD@AHAM

Coverage

2300 sq.ft

Draining

Pump Drainage

Unit Dimensions

21.2" D×22" W×38" H

-

AlorAir® Storm LGR 1250

![AlorAir® Storm LGR 1250]()

![AlorAir® Storm LGR 1250]()

Capacity

264 PPD at Saturation, 125 PPD@AHAM

Size for

3000 sq.ft

Draining

Pump Drainage

Unit Dimensions

26.1" D x15.5" W x17.6" H

-

AlorAir® Storm LGR 1250X

![AlorAir® Storm LGR 1250X]()

Capacity

264 PPD at Saturation, 125 PPD@AHAM

Coverage

3000 sq.ft

Draining

Pump Drainage

Unit Dimensions

26.1" D x15.5" W x17.6" H

-

AlorAir® Storm LGR 850

![AlorAir® Storm LGR 850]()

![AlorAir® Storm LGR 850]()

Capacity

180 PPD at Saturation, 85 PPD@AHAM

Size for

2300 sq.ft

Draining

Pump Drainage

Unit Dimensions

21" D×11.6" W ×17.3" H

-

AlorAir® Storm LGR 850X

![AlorAir® Storm LGR 850X]()

Capacity

180 PPD at Saturation, 85 PPD@AHAM

Coverage

2300 sq.ft

Draining

Pump Drainage

Unit Dimensions

21" D×11.6" W ×17.3" H

-

AlorAir® Storm LGR Extreme Smart App Control

![AlorAir® Storm LGR Extreme Smart App Control]()

![AlorAir® Storm LGR Extreme Smart App Control]()

![AlorAir® Storm LGR Extreme Smart App Control]()

![AlorAir® Storm LGR Extreme Smart App Control]()

Capacity

180 PPD at Saturation, 85 PPD@AHAM

Coverage

2300 sq.ft

Draining

Pump Drainage

Unit Dimensions

22.8" D ×13.7" W ×17.3" H

-

AlorAir® Storm LGR Extreme (Hot Sale)

![AlorAir® Storm LGR Extreme (Hot Sale)]()

![AlorAir® Storm LGR Extreme (Hot Sale)]()

![AlorAir® Storm LGR Extreme (Hot Sale)]()

![AlorAir® Storm LGR Extreme (Hot Sale)]()

Capacity

180 PPD at Saturation, 85 PPD@AHAM

Size for

2300 sq.ft

Draining

Pump Drainage

Unit Dimensions

22.8" D ×13.7" W ×17.3" H

Commercial & Industrial Dehumidifiers

-

AlorAir® PureAiro HEPA Max 970

![AlorAir® PureAiro HEPA Max 970]()

Built-in UV-C light

Yes

Airflow

270-750 CFM

Size for

1100 sq.ft

Filtration system

MERV-10 filter and HEPA/activated carbon filter

-

AlorAir® PureAiro HEPA Max 870

![AlorAir® PureAiro HEPA Max 870]()

Built-in UV-C light

Yes

Airflow

270-550 CFM

Size for

800 sq.ft

Filtration system

MERV-10 -filter and HEPA/activated carbon filter

-

AlorAir® PureAiro HEPA Max 770

![AlorAir® PureAiro HEPA Max 770]()

Built-in UV-C light

No

Airflow

270-550 CFM

Size for

800 sq.ft

Filtration system

MERV-10 filter and HEPA/activated carbon filter

-

AlorAir® PureAiro HEPA Pro 970

![AlorAir® PureAiro HEPA Pro 970]()

Built-in UV-C light

Yes

Airflow

270-750 CFM

Size for

1100 sq.ft

Filtration system

MERV-10 filter and HEPA/activated carbon filter

-

AlorAir® PureAiro HEPA Pro 870

![AlorAir® PureAiro HEPA Pro 870]()

Built-in UV-C light

Yes

Airflow

270-550 CFM

Size for

800 sq.ft

Filtration system

MERV-10 filter and HEPA/activated carbon filter

-

AlorAir® PureAiro HEPA Pro 770

![AlorAir® PureAiro HEPA Pro 770]()

Built-in UV-C light

No

Airflow

270-550 CFM

Size for

800 sq.ft

Filtration system

MERV-10 filter and HEPA/activated carbon filter

-

AlorAir® Cleanshield HEPA 550 (Hot Sale)

![AlorAir® Cleanshield HEPA 550 (Hot Sale)]()

![AlorAir® Cleanshield HEPA 550 (Hot Sale)]()

![AlorAir® Cleanshield HEPA 550 (Hot Sale)]()

![AlorAir® Cleanshield HEPA 550 (Hot Sale)]()

Built-in UV-C light

No

Airflow

270-550 CFM

Size for

800 sq.ft

Filtration system

MERV-10 filter and HEPA/activated carbon filter

-

Purisystems S1 UVIG Air Scrubber

![Purisystems S1 UVIG Air Scrubber]()

New Tech

Built-in UV-C light and ionizer

Airflow

200-900 CFM

Size for

1100 sq.ft

Filtration system

Pre-filter and HEPA filter

-

Purisystems S1 UV Air Scrubber

![Purisystems S1 UV Air Scrubber]()

Built-in UV-C light

Yes

Airflow

200-900 CFM

Size for

1100 sq.ft

Filtration system

Pre-filter and HEPA filter

-

Purisystems S1 Air Scrubber

![Purisystems S1 Air Scrubber]()

Built-in UV-C light

No

Airflow

200-900 CFM

Size for

1100 sq.ft

Filtration system

Pre-filter and HEPA filter

-

Purisystems HEPA 600 UVIG (Medical Grade)

![Purisystems HEPA 600 UVIG (Medical Grade)]()

New Tech

Built-in UV-C light and lonizer

Airflow

270-600 CFM

Size for

800 sq.ft

Filtration system

MERV-10 Filter and HEPA/Activated Carbon Filter

-

Purisystems HEPA Pro UVIG (Industrial Grade)

![Purisystems HEPA Pro UVIG (Industrial Grade)]()

New Tech

Built-in UV-C light and ionizer

Airflow

800-2000 CFM

Size for

2500 sq.ft

Filtration system

MERV-8 Filter and H13 Clapboard Filter

-

Purisystems S2 Air Scrubber (Industrial Grade)

![Purisystems S2 Air Scrubber (Industrial Grade)]()

Built-in UV-C light

No

Airflow

800-2000 CFM

Size for

2500 sq.ft

Filtration system

Pre-filter and HEPA filter

-

Purisystems S2 UV Air Scrubber (Industrial Grade)

![Purisystems S2 UV Air Scrubber (Industrial Grade)]()

Built-in UV-C light

Yes

Airflow

800-2000 CFM

Size for

2500 sq.ft

Filtration system

Pre-filter and HEPA filter

-

Purisystems S2 UVIG Air Scrubber (Industrial Grade)

![Purisystems S2 UVIG Air Scrubber (Industrial Grade)]()

New Tech

Built-in UV-C light and ionizer

Airflow

800-2000 CFM

Size for

2500 sq.ft

Filtration system

Pre-filter and HEPA filter

Commercial HEPA Air Scrubbers

-

AlorAir® Purecare 1050IG

![AlorAir® Purecare 1050IG]()

Built-in Ionizer

No

AirFlow

850-1050 CFM

Sound Pressure Level

58 DBA

Filters

MERV-13

-

AlorAir® Purecare 1050

![AlorAir® Purecare 1050]()

Built-in Ionizer

No

AirFlow

850-1050 CFM

Sound Pressure Level

58 DBA

Filters

MERV-13

-

AlorAir® Purecare 780S

![AlorAir® Purecare 780S]()

Built-in Ionizer

No

AirFlow

580-780 CFM

Sound Pressure Level

58 DBA

Filters

MERV-13

-

AlorAir® Purecare 1080IG

![AlorAir® Purecare 1080IG]()

Built-in Ionizer

Yes

AirFlow

780/1080CFM

Sound Pressure Level

60 DBA

Filters

3 X MERV-11

-

AlorAir® Purecare 1080

Built-in Ionizer

No

AirFlow

780/1080CFM

Sound Pressure Level

60 DBA

Filters

3 X MERV-11

-

AlorAir® Purecare 780IG

![AlorAir® Purecare 780IG]()

Built-in Ionizer

Yes

AirFlow

580/780CFM

Sound Pressure Level

50 DBA

Filters

3 X MERV-11

-

AlorAir® Purecare 780

![AlorAir® Purecare 780]()

Built-in Ionizer

No

AirFlow

580/780CFM

Sound Pressure Level

50 DBA

Filters

3 X MERV-11

-

AlorAir® Purecare 1350IG

![AlorAir® Purecare 1350IG]()

Built-in Ionizer

Yes

AirFlow

1050-1350 CFM

Sound Pressure Level

69 DBA

Filters

4 X MERV-11

-

AlorAir® Purecare 1350

![AlorAir® Purecare 1350]()

Built-in Ionizer

No

AirFlow

1050-1350 CFM

Sound Pressure Level

69 DBA

Filters

4 X MERV-11

-

Purisystems Puricare 1100

![Purisystems Puricare 1100]()

Built-in lonizer

No

AirFlow

1100 CFM

Sound Pressure Level

66 DBA

Filters

5-Micron Filter (Outer), 1-Micron Filter (Inner)

-

Purisystems Puricare 1100IG

![Purisystems Puricare 1100IG]()

Built-in lonizer

Yes

AirFlow

1100 CFM

Sound Pressure Level

66 DBA

Filters

5-Micron Filter, 1-Micron Filter

-

Purisystems Puricare 500

![Purisystems Puricare 500]()

Built-in lonizer

No

AirFlow

500 CFM

Sound Pressure Level

61 DBA

Filters

5-Micron Filter, 1-Micron Filter

-

Purisystems Puricare 500IG

![Purisystems Puricare 500IG]()

Built-in lonizer

Yes

AirFlow

500 CFM

Sound Pressure Level

61 DBA

Filters

5-Micron Filter (Outer), 1-Micron Filter (Inner)

Woodshop Air Filtration System

-

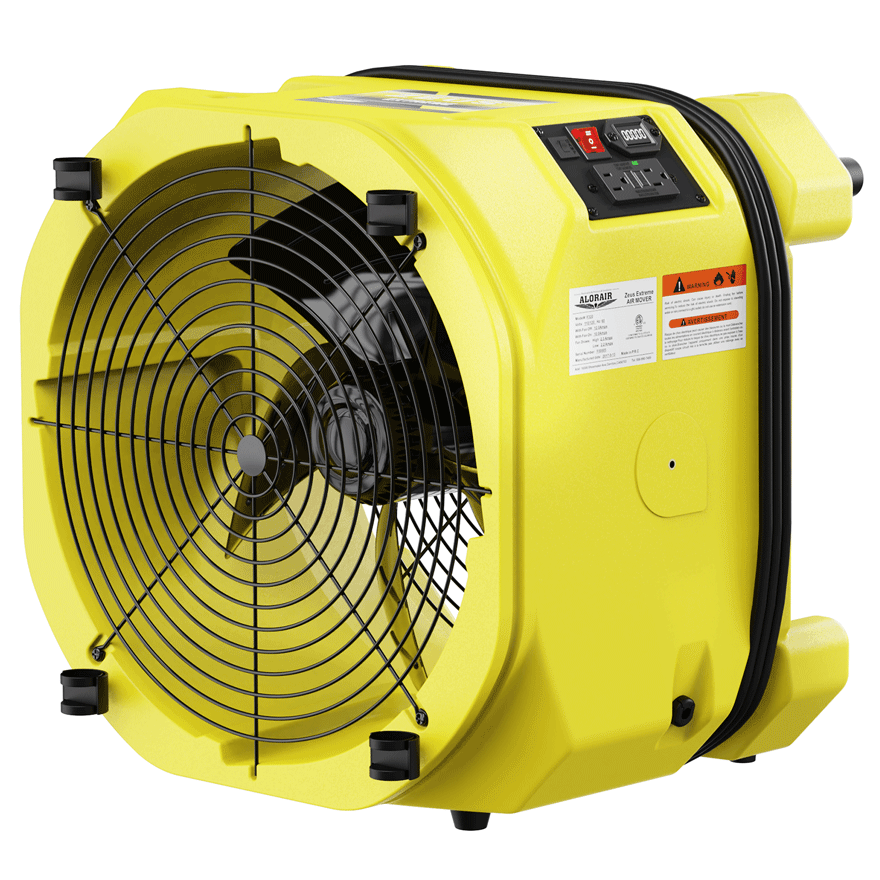

AlorAir® Zeus Extreme Axial Air Mover

![AlorAir® Zeus Extreme Axial Air Mover]()

Air Flow

3000cfm

Power

2.3 Amps

Speed Control

2-Speed Control

Unit Dimensions

20.1" D x 20.1" W x 16.1" H

-

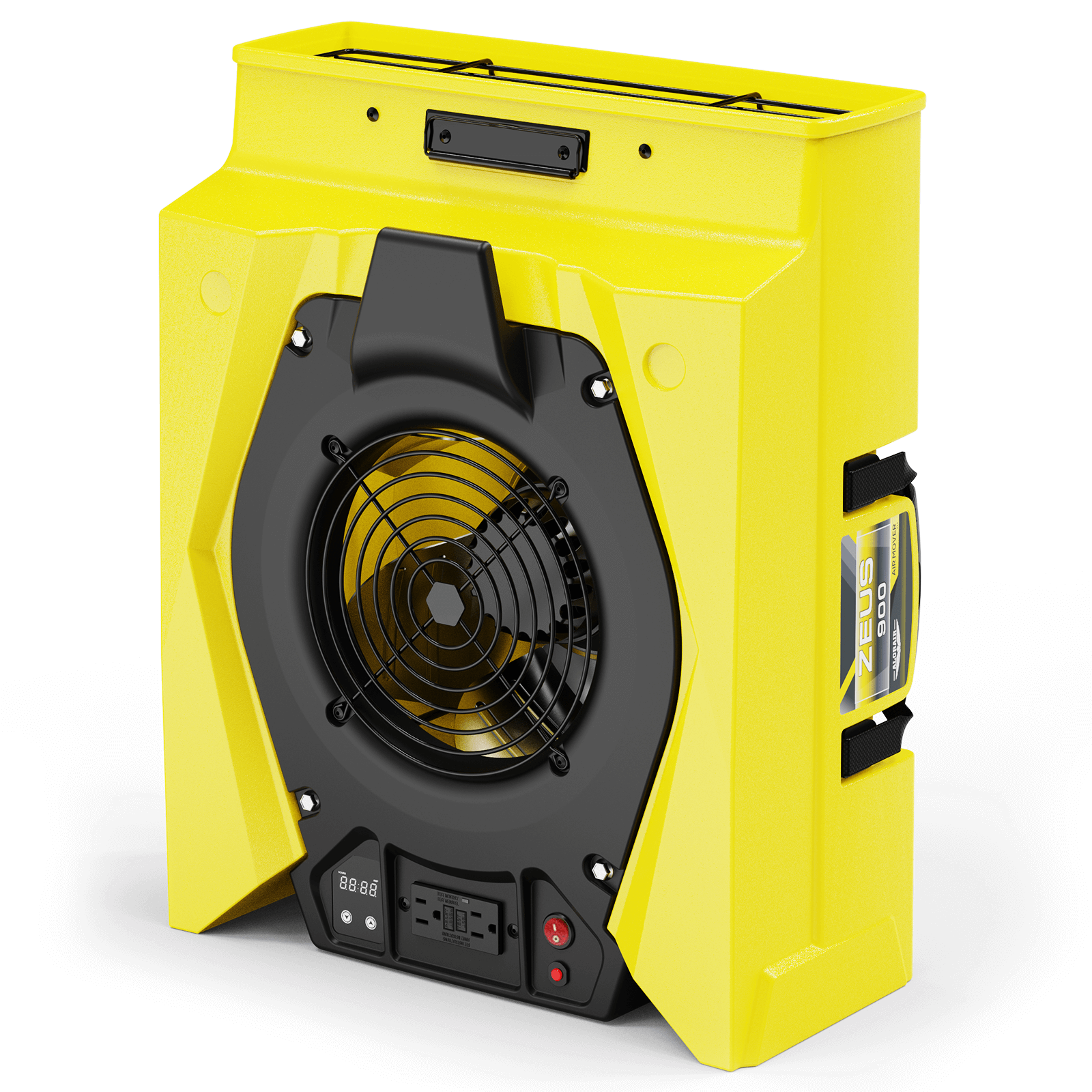

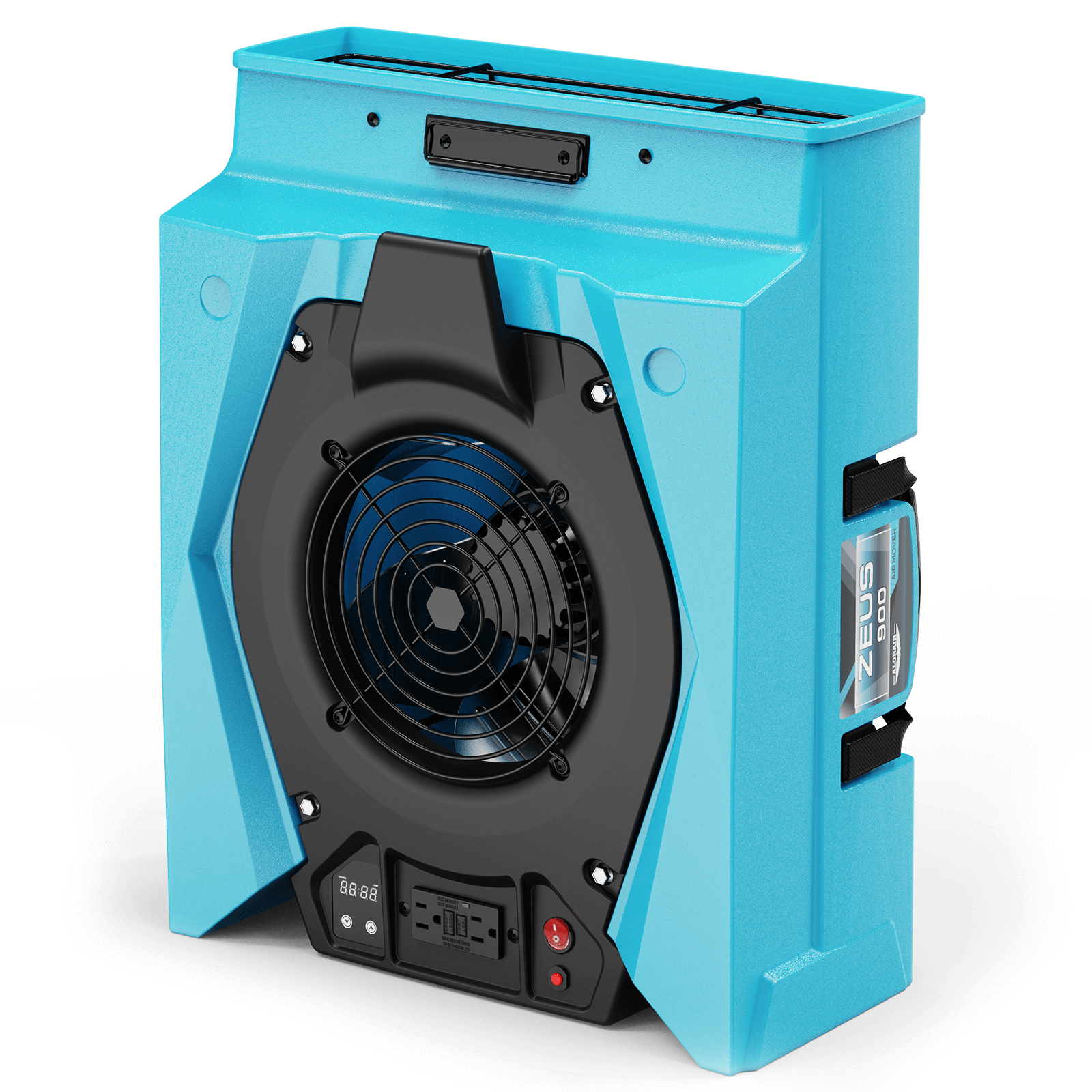

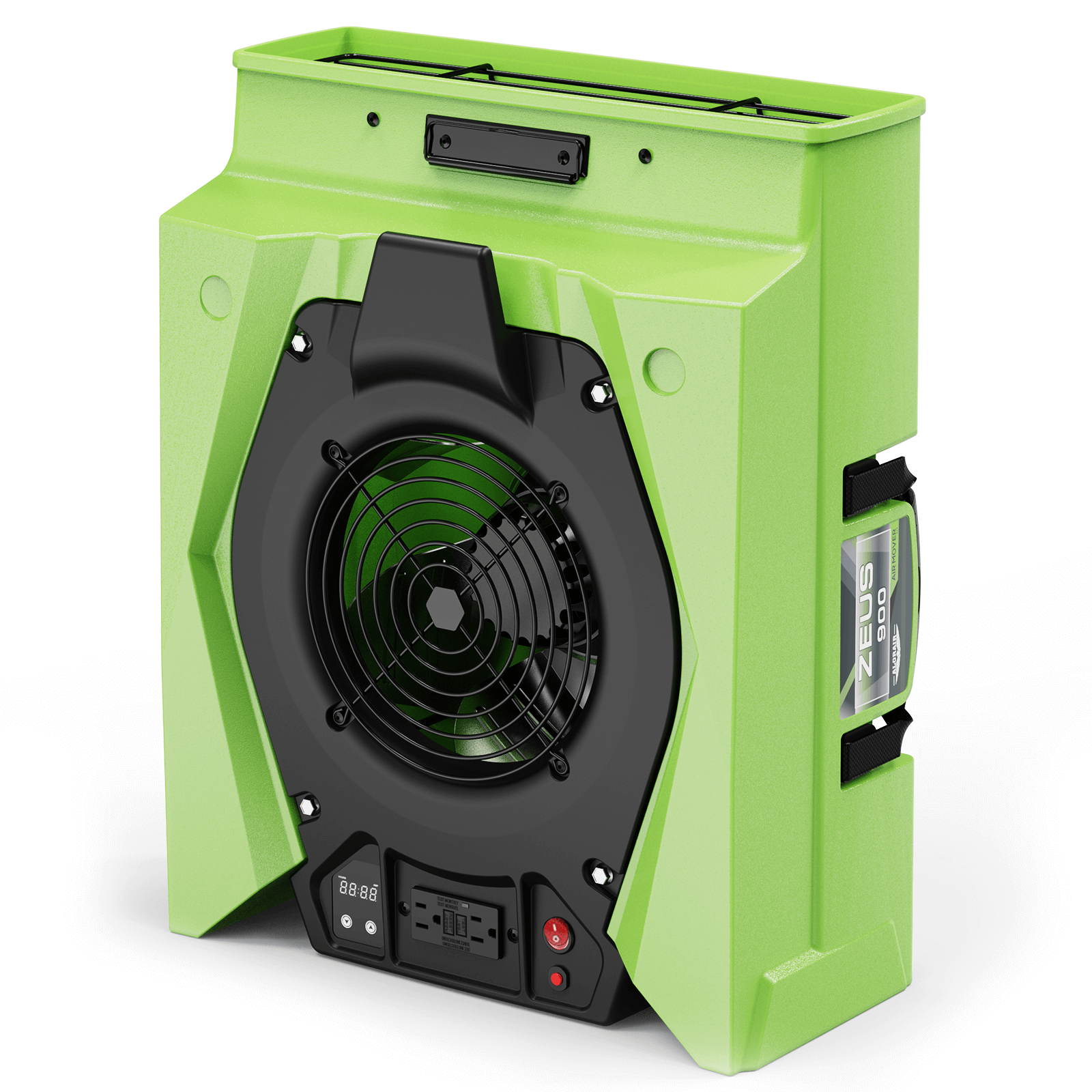

AlorAir® Zeus 900 Air Mover

![AlorAir® Zeus 900 Air Mover]()

![AlorAir® Zeus 900 Air Mover]()

![AlorAir® Zeus 900 Air Mover]()

![AlorAir® Zeus 900 Air Mover]()

Air Flow

950 CFM

Power

1.8 Amps

Speed Control

8-Speed Control

Unit Dimensions

21.6" D x17.3" W x9.8" H

-

AlorAir® 600 CFM Air Mover Blower Fan

![AlorAir® 600 CFM Air Mover Blower Fan]()

![AlorAir® 600 CFM Air Mover Blower Fan]()

![AlorAir® 600 CFM Air Mover Blower Fan]()

Air flow

600 CFM

Speed Control

3 Speed Control

Sound Pressure Level

< 65 dBA

Unit Dimensions

11.81x9.41x12.52in

-

AlorAir® GE1000AT Air Mover Blower Fan

![AlorAir® GE1000AT Air Mover Blower Fan]()

Air Flow

1000 CFM

Operating Voltage

110V-120V, 60Hz

Speed Control

3-Speed Control

Unit Dimensions

14.25*12.79*10.62 in

-

AlorAir® GE1000T Air Mover Blower Fan

![AlorAir® GE1000T Air Mover Blower Fan]()

Air Flow

1000 CFM

Operating Voltage

110V-120V, 60Hz

Speed Control

3-Speed Control

Unit Dimensions

14.25*12.79*10.62 in

-

AlorAir® GE1000A Air Mover Blower Fan

![AlorAir® GE1000A Air Mover Blower Fan]()

Air Flow

1000 CFM

Operating Voltage

110V-120V, 60Hz

Speed Control

3-Speed Control

Unit Dimensions

14.25*12.79*10.62 in

-

AlorAir® GE1000 Air Mover Blower Fan

![AlorAir® GE1000 Air Mover Blower Fan]()

Air Flow

1000 CFM

Operating Voltage

110V-120V, 60Hz

Speed Control

3-Speed Control

Unit Dimensions

14.25*12.79*10.62 In

-

AlorAir® GE4000HCW Air Mover Blower Fan

![AlorAir® GE4000HCW Air Mover Blower Fan]()

Air Flow

4000 CFM

Wattage

1000 Watts

Speed Control

3-Speed Control

Unit Dimensions

18.6"D x 16"W x 20.2"H

-

AlorAir® GE4000HTC Air Mover Blower Fan

![AlorAir® GE4000HTC Air Mover Blower Fan]()

Air Flow

4000 CFM

Wattage

1000 Watts

Speed Control

3-Speed Control

Unit Dimensions

18.6"D x 15.98"W x 20.2"H

-

AlorAir® GE4000TC Air Mover Blower Fan

![AlorAir® GE4000TC Air Mover Blower Fan]()

Air Flow

4000 CFM

Wattage

1000 Watts

Speed Control

3-Speed Control

Unit Dimensions

18.6"D x 16"W x 20.2"H

-

AlorAir® GE3000HCW Air Mover Blower Fan

![AlorAir® GE3000HCW Air Mover Blower Fan]()

Air Flow

3000 CFM

Wattage

623 Watts

Speed Control

3-Speed Control

Unit Dimensions

17.24"D x 14.02"W x 16.04"H

-

AlorAir® GE4000T Air Mover Blower Fan

![AlorAir® GE4000T Air Mover Blower Fan]()

Air Flow

4000 CFM

Wattage

1000 Watts

Speed Control

3-Speed Control

Unit Dimensions

18.6"D x 16"W x 20.2"H

-

AlorAir® GE3000HTC Air Mover Blower Fan

![AlorAir® GE3000HTC Air Mover Blower Fan]()

Air Flow

3000 CFM

Wattage

623 Watts

Speed Control

3-Speed Control

Unit Dimensions

17.24"D x 14.02"W x 16.06"H

-

AlorAir® GE3000TF Air Mover Blower Fan

![AlorAir® GE3000TF Air Mover Blower Fan]()

Air Flow

3000 CFM

Wattage

623 Watts

Speed Control

3-Speed Control

Unit Dimensions

17.8"D x 14.02"W x 15.98"H

-

AlorAir® GE3000T Air Mover Blower Fan

![AlorAir® GE3000T Air Mover Blower Fan]()

Air Flow

3000 CFM

Wattage

623 Watts

Speed Control

3-Speed Control

Unit Dimensions

17.24"D x 14.02"W x 16.06"H

-

AlorAir® GE2000HCW Air Mover Blower Fan

![AlorAir® GE2000HCW Air Mover Blower Fan]()

Air Flow

2000 CFM

Wattage

224 Watts

Speed Control

3-Speed Control

Unit Dimensions

17.24"D x 14.02"W x 16.06"H

-

AlorAir® GE2000TF Air Mover Blower Fan

![AlorAir® GE2000TF Air Mover Blower Fan]()

Air Flow

2000 CFM

Wattage

224 Watts

Speed Control

3-Speed Control

Unit Dimensions

17.8"D x 14.02"W x 15.98"H

-

AlorAir® GE2000T Air Mover Blower Fan

![AlorAir® GE2000T Air Mover Blower Fan]()

Air Flow

2000 CFM

Wattage

224 Watts

Speed Control

3-Speed Control

Unit Dimensions

17.24"D x 14.02"W x 16.06"H

-

AlorAir® Air Drying System

![AlorAir® Air Drying System]()

Floor Area

40.2 Square Feet

Capacity

50 Pints

Special Feature

Continuous Draining

Product Dimensions

13.9"D x 13.3"W x 12.21"H

Air Mover

-

AlorAir® Storm SLGR 850X

![AlorAir® Storm SLGR 850X]()

Capacity

180 PPD at Saturation, 85 PPD@AHAM

Size for

2300 sq.ft

Draining

Pump Drainage

Unit Dimensions

21" D×11.6" W×17.3" H

-

AlorAir® Storm SLGR 1600X

![AlorAir® Storm SLGR 1600X]()

Capacity

275 PPD at Saturation, 160 PPD@AHAM

Size for

4000 sq.ft

Draining

Pump Drainage

Unit Dimensions

31.9" D ×20" W ×18" H

SLGR Dehumidifiers

-

AlorAir® Ventirpro 720

![AlorAir® Ventirpro 720]()

Power

115 V 60 Hz; 0.7 A

AirFlow

720 CFM

Material

Galvanized Sheet

Operating Humidity

5 to 80% RH

-

AlorAir® Ventirpro 540

![AlorAir® Ventirpro 540]()

Power

115 V 60 Hz; 0.51 A

AirFlow

540 CFM

Material

Galvanized Sheet

Operating Humidity

5 to 80% RH

-

AlorAir® Ventirpro 260

![AlorAir® Ventirpro 260]()

Power

115 V 60 Hz; 0.25 A

AirFlow

260 CFM

Material

Galvanized Sheet

Operating Humidity

5 to 80% RH

-

AlorAir® VentirMax 780SD

![AlorAir® VentirMax 780SD]()

Power

115 V/ 60 Hz, 0.65 A

AirFlow

780 CFM

Operation

Button

Operating Humidity

1 to 99% RH

-

AlorAir® VentirMax 570SD

![AlorAir® VentirMax 570SD]()

Power

115 V/ 60 Hz, 0.52 A

AirFlow

570 CFM

Operation

Button

Operating Humidity

1 to 99% RH

-

AlorAir® VentirMax 300SD

![AlorAir® VentirMax 300SD]()

Power

115 V 60 Hz; 0.38 A

Airflow

300 CFM

Operation

Button

Operating Humidity

1 to 99% RH

-

AlorAir® VentirPro-S2

![AlorAir® VentirPro-S2]()

Power

100 to 230V AC, 0.8A

Airflow

0-240 CFM (Air-out)

Noise

0-48 dBA

Operating Humidity

20 to 100% RH

-

AlorAir® VentirPro 260S

![AlorAir® VentirPro 260S]()

Power

115 V 60 Hz; 0.25 A

AirFlow

260 CFM

Material

Stainless Steel

Operating Humidity

5 to 80% RH

-

AlorAir® VentirPro 540S

![AlorAir® VentirPro 540S]()

Power

115 V/ 60 Hz, 0.51 A

Airflow

540 CFM

Material

Stainless Steel

Operating Humidity

5 to 80% RH

-

AlorAir® VentirPro 720S

![AlorAir® VentirPro 720S]()

Power

115 V/ 60 Hz, 0.7 A

Airflow

720 CFM

Material

Stainless Steel

Operating Humidity

5 to 80% RH

-

AlorAir® VentirMax 300S

![AlorAir® VentirMax 300S]()

Power

115V/60 Hz, 0.38 A

Airflow

300 CFM

Operation

Knob

Operating humidity

10-80%

-

AlorAir® VentirMax 570S

![AlorAir® VentirMax 570S]()

Power

115V/60 Hz, 0.52 A

Airflow

570 CFM

Operation

Knob

Operating humidity

10-80%

-

AlorAir® VentirMax 780S

![AlorAir® VentirMax 780S]()

Power

115V/60 Hz, 0.65 A

Airflow

780 CFM

Operation

Knob

Operating humidity

10-80%

Ventilation Fans

-

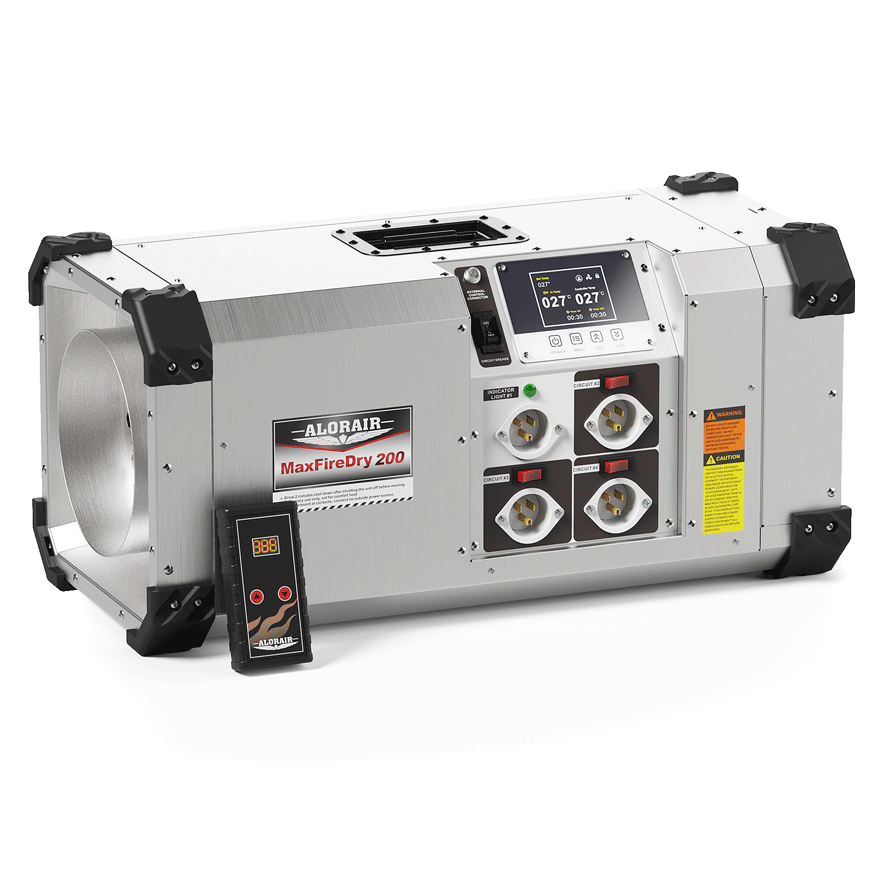

AlorAir® MaxFireDry 200

![AlorAir® MaxFireDry 200]()

Heat Output

20,000 BTUs

Airflow

250 CFM

Size for

Up to 430 Sq.Ft.

Features

PTC heating wires and Remote Control

Electric Heat Drying Systems

-

AlorAir® Vapor Barrier 10mil 10'x50'

![AlorAir® Vapor Barrier 10mil 10'x50']()

-

AlorAir® Vapor Barrier 10mil 10'x65'

![AlorAir® Vapor Barrier 10mil 10'x65']()

-

AlorAir® Vapor Barrier 10mil 10'x100'

![AlorAir® Vapor Barrier 10mil 10'x100']()

-

AlorAir® Vapor Barrier 12mil 10'x100'

![AlorAir® Vapor Barrier 12mil 10'x100']()

-

AlorAir® Crawl Space Vapor Barrier

![AlorAir® Crawl Space Vapor Barrier]()

Crawl Space Encapsulation and Repair

-

- Shop

Product Categories

-

Crawl Space & Basement Dehumidifiers

![Crawl Space & Basement Dehumidifiers]()

-

Whole House Dehumidifiers

![Whole House Dehumidifiers]()

-

Commercial & Industrial Dehumidifiers

![Commercial & Industrial Dehumidifiers]()

-

Commercial HEPA Air Scrubbers

![Commercial HEPA Air Scrubbers]()

-

Woodshop Air Filtration System

![Woodshop Air Filtration System]()

-

Air Mover

![Air Mover]()

-

SLGR Dehumidifiers

![SLGR Dehumidifiers]()

-

Ventilation Fans

![Ventilation Fans]()

-

Electric Heat Drying Systems

![Electric Heat Drying Systems]()

-

Filter & Other Accessories

![Filter & Other Accessories]()

-

Crawl Space Encapsulation and Repair

![Crawl Space Encapsulation and Repair]()

-

Wifi Dehumidifier

![Wifi Dehumidifier]()

-

-

Applications

Applications

-

Managing Air

-

Basement Dehumidification

-

Carpet Cleaning

-

Crawl Space Dehumidification

-

Fire Damage Restoration

-

Flood Dehumidification

-

Mold Removal

-

Water Damage Restoration

-

Indoor Swimming Pool

-

Grow Room & Tent Optimization

-

Pharmaceutical Production

-

Supermarket Grocery & Retail

-

Warehouse & Storage

-

Laboratory & Cleanrooms

-

Basement Wine Cellar

-

Gyms & Fitness Center

-

Guest Rooms & Hotels

-

- Support

- Learning

- Community

- Blog

- Distributor

-

-

-

Home

/ Who is Responsible for Your House Fire Damage?

Who is Responsible for Your House Fire Damage?

August 24,2020

Sometimes it is not easy to determine who is responsible for given fire damage at your home. A fire may start at your neighbor’s house and spread to your compound. It may seem obvious that your neighbor is responsible for the house fire damage, but alas! The insurance says no.

Natural Causes and Spontaneous Fires

If the fire at your neighbor’s place was started by anything other than your neighbor’s negligence or mistake; if it is sparked off by events such as fireworks that go wayward; or lightning, or a wildfire flame, your neighbor will usually not be expected to carry the burden. A Lot of people think that just because the fire that destroyed your property started at your neighbor’s house, your neighbor will necessarily carry the blame and pay for the damages. Well, insurance companies have exceptions to what they can pay for. Moreover, the general insurance rule is that it covers damages resulting from fire occurring at the principal’s property but not the neighbor’s. In other words, the insurance company pays for damages that the owner of the insurance cover caused. If the neighbor was negligent including failing to attend to a grill that sparks off a fire, then such a neighbor is liable through their insurance company. Therefore you do not have to jump to conclusions to think that because the fire started at your neighbor’s place, then such a neighbor is responsible.

Fire Damage Legal Responsibility

Fire damage legal responsibility means that the party that has been insured is liable for any damage to the rental property resulting from a fire. Since the rider allocates responsibility, there must be a proper investigation that will determine whether the owner of the insurance cover is truly responsible for the fire that has caused the damage.

Business Cover

Fire damage legal liability is used in commercial settings and industrial spaces. It also covers the tools and equipment that the owner of the business rents out for commercial purposes. It applies to commercial and industrial space that the owner of the business leases to clients. Such coverage extends to rented garages and other property, so long as such property is under the name of the insurance coverage holder.

Accident Cover

It is a good idea to always be prepared for unfortunate eventualities. Take an accident cover to protect you against fire damage, even the one that starts from outside your premises. You never know for sure whether it is your neighbor to blame. The only entity you can count on to pay for your fire damage is your insurance company.

Get fire damage restoration service

A quick response is essential. If it can be resolved quickly, most of the damage to your house and property caused by fire, water, and smoke can be repaired. However, if it is not inspected, items can change from being washable to non-recyclable in just a few days. AlorAir provides equipment such as dehumidifiers for drying and air scrubbers to remove smoke. Consider using one of them to help reduce property damage.

Summary

The bottom-line of this piece is that you should not look to someone else to cater to your fire damage fixes. In other words, everyone must make an effort to purchase insurance coverage. Compensation of damages is usually a result of thorough investigation and the facts are subjected to many policy and legal scales. Make sure that you take an insurance cover that caters to you when accidents such as a fire happen.

-(1).png)

.jpg)

.jpg)

.jpg)

.jpg)

.HDi90.png)

.HD90.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.webp)

.webp)

.webp)

.webp)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

-.jpg)

.jpg)

.jpg)

.jpg)

Exclusive

offers promotions

Exclusive

offers promotions